The Current Way

- Lack of Quality Homes

- Non-Professional Owners

- Poor Public Image

The Sonos Capital Way

- Professionally Managed

- Improved Occupancy Rate

- Increased Revenue & Profitability

- Enhanced Public Image

- High Quality Affordable Housing

About investing in Manufactured Home Parks

Manufactured Housing Communities Offer Tremendous Investment Potential! Manufactured homes are one of the most affordable housing options there is, and because of this known fact there are manufactured housing communities in almost every city and state across the USA. While the community residents typically own their home the property that the home is situated on rented land.

Private investment in manufactured housing communities has been rising for years. Since zoning laws and property restrictions make it difficult to create new manufactured housing communities any new competition in the future for this area of the housing market is almost nonexistent.

Fund Terms and Returns

| $1 Million minimum offering amount |

| $10 Million maximum offering amount |

| $50,000 minimum investment |

| Term: Up to 6 years |

| Quarterly Distributions |

| Cash Investment, Self Directed IRA and other retirement account options may be used |

| Reg D, Rule 506(C) Offering to Accredited Investors Only |

| Limited number of investors |

Investments For Income

Between low interest rates and high market volatility, investing for income has become increasingly challenging. Sonos Capital Fund 2 allows investors to capitalize on a niche market segment offering outsized returns.

The Creation of Value

An investment in Sonos Capital Fund 2 presents us with an opportunity to build partnerships with each of our investors, both for this fund and the opportunities that are expected to follow.

Long Term Investor Partnerships

We use lean systems for property management and programs for aggressive optimization in order to create value for our investors. We have found that this is a better strategy than trying to time market factors or hoping for blind luck.

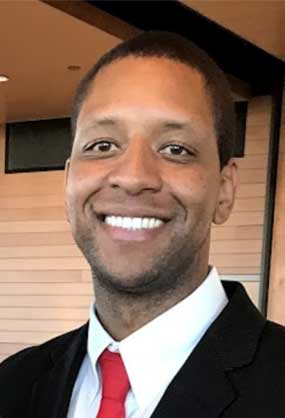

Walter Johnson

Founder & CEO

Mr. Johnson is a Finance Professional and Real Estate Investor/Syndicator with 16+ years of experience serving the Real Estate and Banking Industries. Over the years, he has served in various capacities from Real Estate Investor & Vice President to High Converting Banker & Sales Manager. He is adept at spearheading strong teams and creating robust business development plans. He is an avid seeker of knowledge who highly appreciates the notion of continuous improvement and aspires to become an industry leader. Driven by the desire to influence and impact other’s lives for the better, he is passionate about inspiring the generations of today and tomorrow to strive for long-term business success and prosperity.

Mr. Johnson embarked on his professional journey from Security Mortgage Corporation in 2004 and served them diligently for the next four years. As the Sales Development, Mortgage Banker, and Sales Manager, he was able to successfully formulate lucrative strategic business plans that helped the business increase the sales revenue by 25%.

In 2009, Mr. Johnson made a move to AmeriFirst Financial Inc. and served them as Sales Manager/Banker for the next two years. During this stint, he managed a $7 million loan portfolio and played an instrumental role in augmenting the profit margin by 20%. Mr. Johnson’s active contributions to designing programs and financing options driving business growth were highly commended for his efforts in structuring, negotiating, and closing several high-profile leads. Recognized as “Top Producer”, his efforts helped the business expand the customer base by 40% and increase the targeted monthly volume to $5 million.

Following this, Johnson served Quicken Loans as High Converting Banker for one year before taking over the responsibilities of the Vice President at Freedom Mortgage. Among his many notable achievements, he helped the business generate $882 million in sales in 2015 and designed a Direct Mail Campaign driving a 140% increase in revenue. Mr. Johnson also spearheaded the development of new offices and streamlined business processing to ensure progressive growth. His active collaboration in building robust strategic relationships with service partners helped the business consistently generate leads at a higher conversion rate.

Mr. Johnson presently serves as the Multi-Family Real Estate Investor/Syndicator at Sonos Capital – a private company sourcing Manufactured Home Parks and Apartment Building opportunities. He actively works with leading accredited & non-accredited investors, real estate professionals, banking institutions, and vendors to help them master the art of investing and capitalize on growth opportunities. He derives his greatest inspiration from stirring a positive change in the community and improving lives.

Mr. Johnson was recently appointed by Governor John Giles to serve on the Housing & Community Development Advisory Board of Mesa, Arizona. In this role, he will assist with providing valuable direction and leadership to the City of Mesa, AZ.

In addition, Mr. Johnson is a sports enthusiast who loves playing volleyball and devotes his leisure time to polishing his athletic skills. To him, sports is much more than a passion as it helps him build greater focus and increase workplace productivity. He relishes traveling the country and following sports competition and is also a fan of scuba diving, fishing, and off-roading. He enjoys giving his time to charity and is always on the lookout for an opportunity to contribute to the growth and development of a prosperous society.

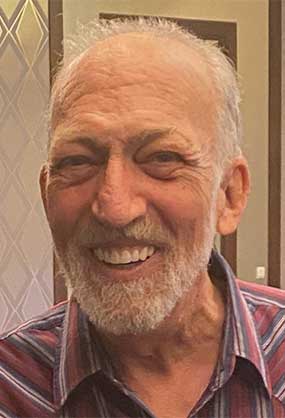

Jill Jensen

Chief Investment Officer

Jill Jensen is an entrepreneurial force who has been shaping the landscape of sales since 2010. Her journey into real estate began in 2022, where she strategically invested in multiple mobile home parks and directed her capital towards funds for multifamily properties. A savvy entrepreneur, Jill excels in raising capital for real estate investors and business owners, showcasing her financial acumen.

Jill's business trajectory started with remarkable success in door-to-door sales, achieving over six figures in just five months selling pest control. This accomplishment led to the establishment of her own pest control company, expanding nationwide and generating multiple million dollars annually.

Jill's expertise extends beyond business – she is a proud member of the SubTo community, serving as a leader for those eager to delve into real estate investment. Most recently, Jill expanded her skill set by becoming a life insurance agent.

Born and raised in Utah, Jill brings joy to life and has a magnetic presence that lights up any room. Her love for BYU football, the mountains, and travel aligns with her passion for connecting with like-minded individuals. A dedicated single mom to two beautiful daughters.

Jill is not only driven by her entrepreneurial spirit but also by a desire to support other single moms facing challenges. Jill's vision goes beyond business success; she strives to be a role model for her daughters and other women in the entrepreneurial space. With a heart for giving back, Jill is a driven visionary, making a lasting impact on the world and leaving a legacy of empowerment for those she touches.

Dayna

Corlito

Controller /

Operations

Mike

Taylor

Community

Development

Michael

Newman

Capital

Advisor

Neal

Haney

Occupancy

Advisor

Investor Advantages to Consider With Sonos Capital, LLC

Income Stability

Market dependability as MHC's have verifiably shown a low relationship to the more extensive market. Moreover, occupant security and life span because of "stability" of manufactured houses lead to more prominent consistency of pay when contrasted with other resource classes.

Tax Benefits

Quickened deterioration is taken into account "land upgrades" (15 years versus 27.5 years for most private land) and may bring about the deferral of a lot of a financial specialist's taxation rate.

Is This Investment Right for Me?

Only you can decide whether an investment in Sonos Capital, LLC is right for you or not. Every case and situation is different and unique, and you need to consider all of the relevant and important factors in your case before you make any investment decision.

Capital Preservation

The Fund may offer broadening and security as it intends to obtain MHC's that produce solid income situated in different states. Likewise, the Fund is overseen by Key Principals who speak to a solid and experienced group in the MHC business.

CONTACT US

Please complete the contact form and we will get back to you about any questions you have about our offering.

Sonos Capital - 4343 N. Scottsdale Road Suite 150 - Scottsdale, AZ 85251 — info@sonoscapital.com — (480) 674-2035